The Australian dairy industry can't shrink its way to success, the Australian Dairy Conference in Hobart was told.

Subscribe now for unlimited access.

or signup to continue reading

"You shrink to a much harder game and and you've got different challenges," Freshagenda dairy market analyst Steve Spencer said in a conference session addressing the industry's growth conundrum.

A smaller industry would be more exposed to fierce competition from importers - particularly the US.

"I think the industry is in a lot poorer shape if it goes down the lower-scenario [path]," he said

But he said global market fundamentals suggest commodity prices should remain strong out to 2030, underpinning Australian farmgate prices.

And Australian consumers would continue to support local products - as long as the price was right.

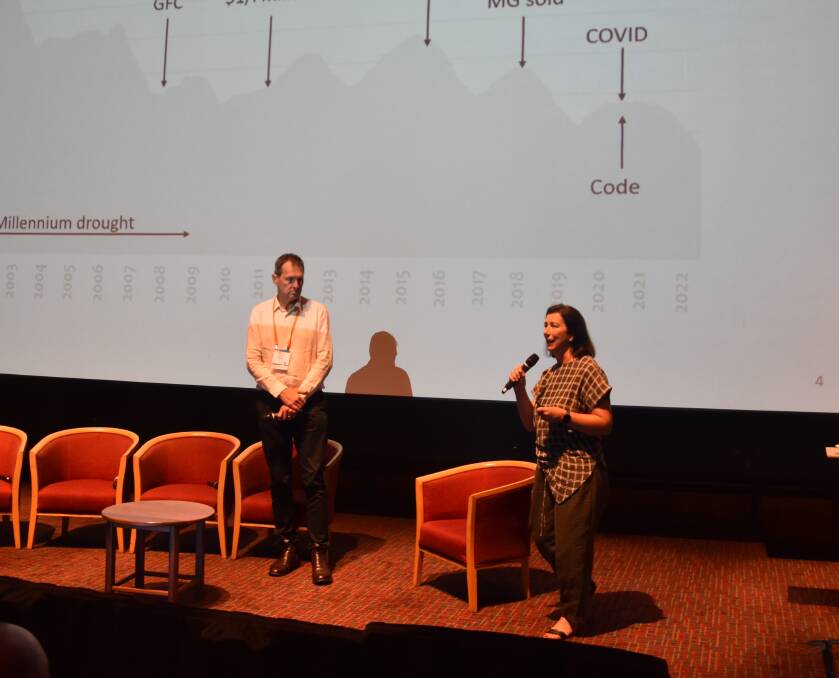

Fellow Freshagenda analyst Jo Bills said a series of shocks had taken Australian milk production down from a peak of 11.2 billion litres to about 8.5b litres.

Ms Bills said these shocks included climate, poor corporate behaviour that had knocked confidence and trust, increasing farm complexity, calls for sustainability measures that challenged some people, increased competition for labour, land and water resources, and rising capital prices that potentially created a barrier for new entrants and made succession planning more challenging.

She said the challenges to growth for the sector had been discussed at an industry workshop organised by the Australian Dairy Conference last year.

"The industry culture was a big topic of discussion in the workshop, and that's going to be critical to stabilising and growing in the future," she said.

But she also pointed out that rational decisions by individuals to realise the value they had built into their businesses and to leave the dairy industry were not necessarily sad stories.

"But it doesn't necessarily answer the industry call for growth," she said.

Mr Spencer said there were big factors at play at the moment in the global and Australian markets.

"What happens to the global industry is very important for Australia," he said.

He said a number of factors were at play that held incredible uncertainty for the world and shaped the commodity and food markets.

He said these included the renewable energy transition, evolving demographics on farm and among consumers, the macro shocks and how the world recovered from COVID-19.

He said geopolitics was a big factor - particularly the war in Europe and how that unfolded.

"Every part of our supply chain is relentlessly impacted by these changes," he said.

He said this also made forecasting "pretty tough" in the short term and almost impossible beyond that.

But he said scenarios could be developed that created a picture of where the world dairy market was heading.

He said the scenarios were built on the relentless global push towards sustainability, increased political fragmentation, declining European dairy production, stable New Zealand milk production and increased milk production coming out of the US and China.

"Our dairy scenario that falls out of that shows... a much tighter milk supply globally," he said.

But he said as more consumers rejected dairy because they didn't want animal production, there would be a fall in demand for fluid milk products.

"So that scenario's very complicated," he said.

"What it means by the time we get to 2030 is that we've got higher commodity prices than what we've seen recently."

Mr Spencer said this would play into an Australian market that had already experienced some game changers.

"We have a narrow net trade position, we're structurally deficit in butterfat," he said.

"Northern regions are in a year-round shortage now, so that's taking more milk from the south.

"But the big thing is we've got a major grocery chain buying all of its milk for private label milk and cheese at least until 2025.

"So that's changed the entire farmgate dynamic."

He said Australian milk prices were now aligned with import parity pricing - they were no longer set to export parity prices.

"We've had the highest milk value premium over NZ commodity values since we've been analysing things and long before that," he said.

Mr Spencer said the changes underway in the Australian market were going to see a prioritisation of higher-value domestic uses.

"Security of milk is the big thing that's going to drive buyers," he said.

"We're going to see more specialised supply chains.

"We're in no way going be an efficient or world-competitive industry, but we'll be what we call an agile premium niche.

"We'll import commodities, we will avoid making them but from time to time when we fluctuate our milk supply we will have opportunities to toll and trade those commodities into higher value lines."

But Mr Spencer warned this did not mean the Australian dairy industry could simply focus on the Australian market.

"This more expensive high value domestic market we want to keep enshrined that's actually far more attractive to importers," he said.

"They are not going to sit back and let us have this nice premium to ourselves.

"We're already the fourth-largest export market for US cheese and that appeal will only continue to grow.